Introduction

Blockchain technology has revolutionized finance by introducing transparency and decentralization. However, this transparency comes with trade-offs lack of confidentiality, exposure to malicious actors, and vulnerability to Maximal Extractable Value (MEV) attacks. These challenges hinder the adoption of blockchain for enterprises and privacy-conscious users.

To solve these issues, Fluton is bringing Encrypted Intents, powered by Fully Homomorphic Encryption (FHE). Encrypted Intents introduce a new way to execute transactions securely and privately, mitigating MEV attacks while preserving decentralization.

The Problems with Traditional Blockchain Transactions

1. Lack of Confidentiality

While blockchain ensures security and trust through transparency, it lacks robust privacy protections. Pseudonymity is not enough sophisticated analytics can trace transactions back to users, revealing financial behavior. This lack of confidentiality exposes users to:

- Strategy Exploitation: Competitors and malicious actors can analyze and replicate trading strategies, exposing traders to loss of competitive advantage.

- Copy-Trading: Anyone can see the balance of a wallet at any point, so copy-trading becomes particularly easy.

- Regulatory concerns: Enterprises hesitate to adopt blockchain due to the risk of exposing sensitive financial data.

2. MEV Attacks – The "Silent Tax"

MEV, or Maximal Extractable Value, refers to the profits blockchain validators and bots can extract by reordering, censoring, or inserting transactions within a block. These actions distort the market and result in unfair financial outcomes for regular users. The most common MEV tactics include:

- Backrunning: Bots detect profitable arbitrage opportunities and execute trades right after a user’s transaction.

- Frontrunning: A malicious trader sees a large trade order and jumps ahead by submitting their own higher-gas transaction.

- Sandwich Attacks: Bots place buy and sell orders around a user’s trade, manipulating prices for profit.

These practices introduce hidden costs and inefficiencies, making DeFi less attractive to mainstream users and institutions.

Encrypted Intents: A Game-Changer for Privacy and MEV Protection

Encrypted Intents take intent-centric execution further by ensuring transaction details remain private even from solvers and validators. This is made possible by Fully Homomorphic Encryption (FHE), a cryptographic breakthrough that allows computations on encrypted data without decryption.

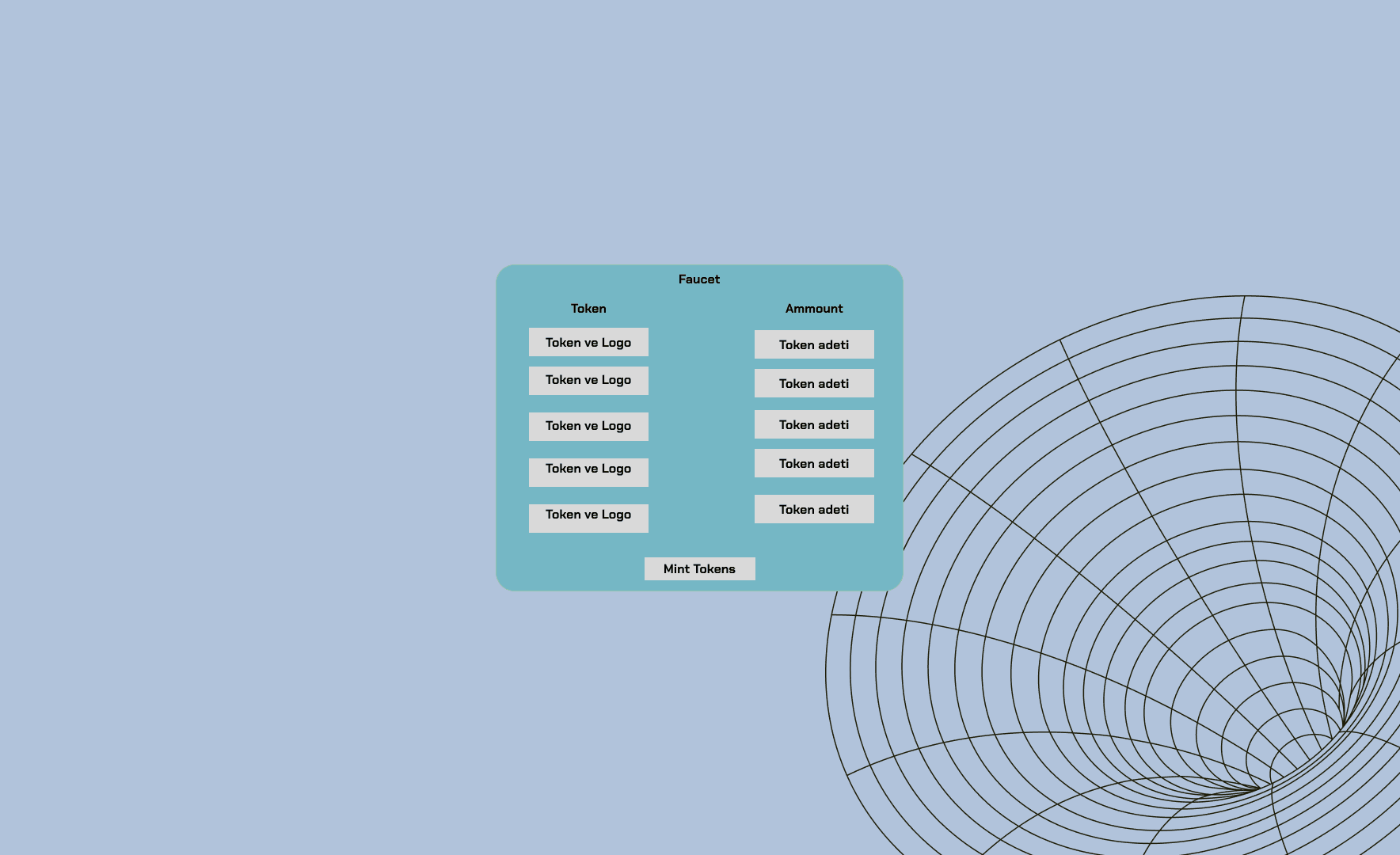

How Encrypted Intents Work

User Defines an Intent: The user specifies an action (e.g., "swap 10 ETH for USDC" or "bridge 100 USDC to another chain"), which is encrypted using FHE.

Solvers Receive the Encrypted Intent and Submit Offers: The encrypted intent is broadcasted to the solvers. Since the intent remains encrypted, the solvers give their offers to the user blindly. The offers usually look like this: “I'll take 1% fee from the amount you're sending but I'm waiting the transaction to be finalized.”, or “I'll take 2% fee + 1$ base fee but I won't wait for finality.”

User Chooses an Offer and Authorizes the Relayer: The user chooses the best offer whatever they're prioritizing, whether it's lower fees or faster execution. Then they authorize a relayer to fulfill their intent. The solver executes the transaction as specified without decrypting the details, ensuring fairness and privacy.

Cross-Chain Settlement: If the transaction involves bridging, encrypted messages coordinate execution across different chains via cross-chain messaging.

Semi-Encrypted vs. Fully-Encrypted Intents

Users can choose between:

- Semi-encrypted Intents: Encrypt only the amount being swapped (lower gas costs, MEV protection).

- Fully-encrypted Intents: Encrypt additional details (e.g., token addresses, target networks) for full privacy (higher gas costs).

Market Implications: Why This Matters for DeFi

For Users

- Better Trading Experience: With Encrypted Intents, users no longer need to worry about frontrunners or sandwich attacks inflating their trading costs. This means fairer pricing and more predictable trade execution.

- Enhanced Privacy: Users can engage in DeFi without exposing their balances, transaction history, or trading strategies to the public.

For Institutions

- Regulatory Compliance & Privacy: Enterprises and institutional investors often hesitate to engage in DeFi due to transparency risks. Encrypted Intents allow them to operate with on-chain privacy, protecting trade secrets and compliance-sensitive data.

- Reduced Market Manipulation: Large transactions (whale trades) are often front-run or manipulated in transparent markets. Encrypted Intents eliminate visibility into pending trades, reducing the risks of slippage and manipulation.

For Developers & Protocols

- New Revenue Models: Protocols can charge for private execution services or introduce novel privacy-based DeFi products powered by Encrypted Intents.

- Expanding DeFi Use Cases: By enabling confidential hooks and automated execution, developers can build new applications like private yield farming strategies, institutional-grade trading solutions, and automated cross-chain workflows.

What’s Next? Future Developments in Encrypted Intents

- Confidentiality Adapter acts as a middleware between the protocol and the user for enabling confidential transactions without requiring changes to existing protocols.

- Users can confidentially interact with a protocol with the help of Confidentiality Adapter.

Automated Execution with Confidential Hooks

- Users can define multi-step transactions, such as: "Bridge 100 USDC to Base, then stake in the highest-yield pool available confidentially."

- This reduces manual steps and improves automation in DeFi.

- AI agents can analyze market conditions and execute optimal transactions.

- Users interact with an AI assistant instead of manually navigating DeFi platforms.

Conclusion: A Privacy-Preserving, MEV-Free Future

Encrypted intents represent a fundamental shift in how blockchain transactions are processed. By combining intent-centric architectures with FHE-powered encryption, Fluton creates a fairer, more efficient, and privacy-respecting DeFi ecosystem.

As adoption grows, we can expect higher institutional participation, more advanced AI-driven execution, and broader cross-chain confidentiality. The future of blockchain is private, secure, and MEV-free and encrypted intents are leading the way.